Diversifying assets is one of the oldest risk management strategies there is. Even though low/negative bond yields have removed forms of fixed income from the diversification toolkit, traditional ways of setting up a portfolio still deserve respect. And in this article, from Joseph Burns of iCapital Network, the case for diversification is given a fresh look. iCapital - which made important new appointments this week - has a platform for alternative assets such as private credit, debt and infrastructure. Such “alternatives” can be less liquid than more conventional assets such as listed equities, and any view of diversification must take differences in liquidity into account.

The editors of this news service are pleased to share these views; the usual editorial disclaimers apply. Jump into the debate! Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

Nobel Prize winner Harry Markowitz once famously referred to diversification as “the only free lunch in finance.” His message was simple and timeless: by allocating capital across a mix of assets, clients can increase the probability of realizing their targeted return over time, with an acceptable level of portfolio volatility.

One of the many challenges for investors is that the benefit of diversification does not really have a constant value. Multi-asset, multi-strategy hedge funds can play a pivotal role in achieving positive results for clients, though there have certainly been periods when diversification can be structured without the benefit of alternative investments. The decade following the Great Financial Crisis is a case-in-point regarding how investors achieved sufficient diversification somewhat simplistically, through a basic “set it and forget it” allocation to public equities and traditional fixed income.

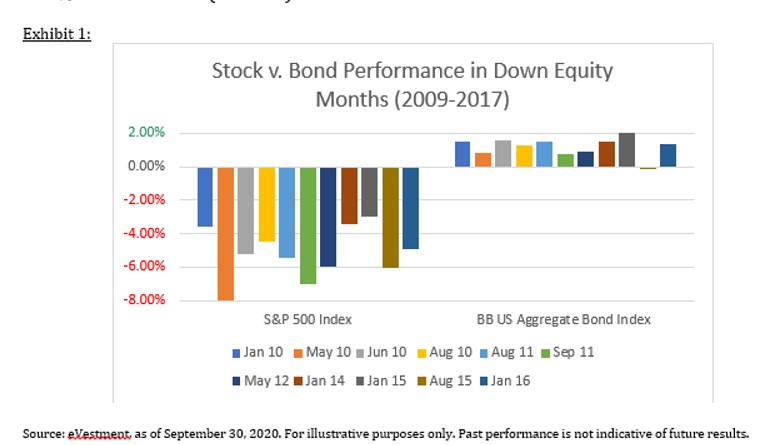

From March 2009 through year-end 2017, $1 million invested in the S&P 500 Index grew to $4.4 million. During that period, fixed income, as measured by the Bloomberg Barclays US Aggregate Bond Index, provided investors with an annualized return of +4 per cent without ever experiencing a loss of -4 per cent. So the return-generating and capital-protecting components of a portfolio were readily available through a stock-bond allocation. But what about the final ingredient of sound portfolio construction: diversification? Did investors achieve high returns, capital protection, AND portfolio diversification through a standard asset allocation?

The answer is a resounding yes. When looking at the 11 months during that time period when the S&P 500 Index declined by at least , fixed income was positive 10 times - only August 2015 broke the trend with a negative return for bonds of just 14 basis points. The average S&P performance for these “negative equity” months was approximately , compared with an average gain of +1.2 per cent for fixed income .

Source: eVestment, as of September 30, 2020. For illustrative purposes only. Past performance is not indicative of future results.

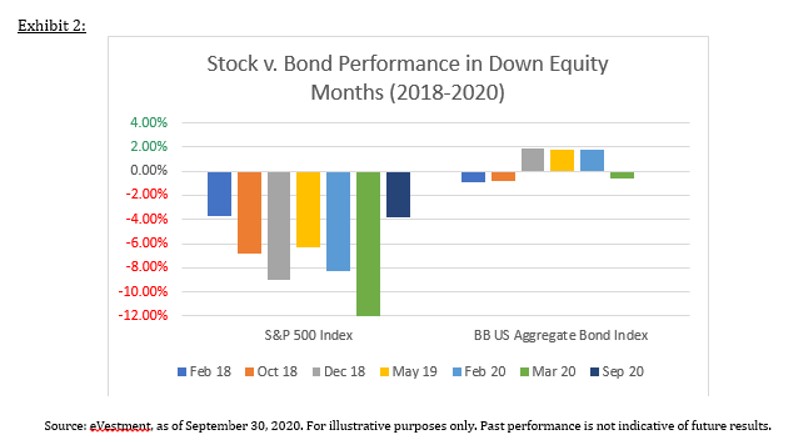

Something has fundamentally changed over the past few years however, with respect to the “negative correlation” between stocks and bonds. Since 2018, the S&P 500 Index has had seven months with losses exceeding . However, bonds were positive just three times - and negative four times - as shown in Exhibit 2.

Source: eVestment, as of September 30, 2020. For illustrative purposes only. Past performance is not indicative of future results.

Not only has the correlation changed, it has shifted along with an increase in the volatility of stocks: the average S&P 500 Index decline has been over the trailing three years. Higher equity risk coinciding with a declining benefit from the “flight-to-quality” that bonds have historically offered creates structural challenges for investors in the current environment. Whether this shift is cyclical or secular is another key consideration.

Looking at that 2009 to 2017 period, we know that the long-term valuation of the S&P 500 was trading at a 20-year low coming out of the economic crisis, with a cyclically adjusted price/earnings ratio of 15x. And with Treasuries yielding north of 3 per cent, there was “room to move” in terms of both stock and bond price appreciation. Fast forward to today, we see that the CAPE ratio for stocks has more than doubled to 32x, reflecting the “richest” valuation for equities since the late 1990s; while the current yield on “safe” bonds has fallen to less than 0.7 per cent. With capital market assumptions for stock and bond performance in the low-to-mid single digits, along with an expectation for continually higher volatility and a potentially deteriorating relationship for equities and fixed income, the need for accessing diversified sources of return has rarely been higher.

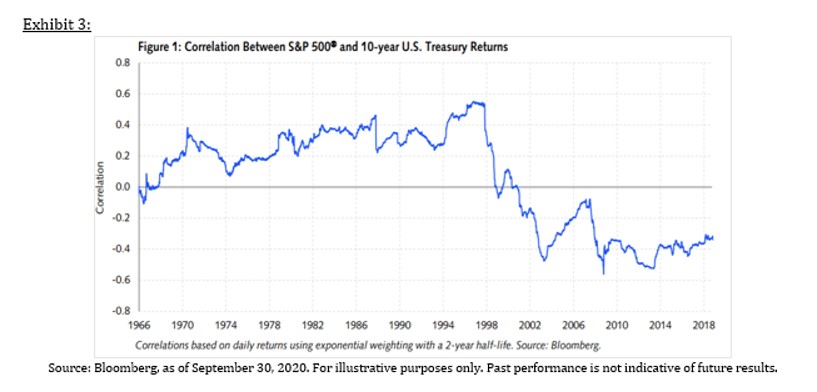

For many clients, and some advisors, their own investing history dates back two decades or so. And since 2000, the relationship between stocks and bonds has been consistently negative, as shown in Exhibit 3. Reviewing this correlation over a longer period suggests that traditional assets have been positively correlated for significant periods of time, and that a false sense of security from stock/bond diversification may be dangerously misplaced. If the past three years are indicative, we may have already entered an environment when bonds will not be the automatic safeguard against declines in the stock market, as many have come to expect.

Source: Bloomberg, as of September 30, 2020. For illustrative purposes only. Past performance is not indicative of future results.

If the relationship between stocks and bonds has indeed shifted, at a time when returns may be harder to come by and volatility is elevated, how can clients avoid missing out on the critical “free lunch” to drive performance while protecting against excess risk? Within hedge funds, the answer is clear: diversified multi-asset, multi-strategy portfolios are purpose-built for this type of environment. Over the past few years, select funds have clearly demonstrated an ability to protect capital in periods like the 4th quarter 2018 and the 1st quarter 2020, while the absolute returns have steadily increased on the back of a correlation breakdown and recent market dislocation.

These types of diversified funds are highly distinct from one another, and hard to lump into a single strategy bucket. Some are among the largest, most established firms in the industry, with track records spanning decades and a proven ability to navigate uncertain market conditions with demonstrated success. Other funds are “right-sized” to consistently access non-beta sources of return in less efficient arbitrage strategies. And some may be considered “emerging” given their comparatively smaller pools of capital, but are managed by experienced practitioners with personal capital invested alongside their limited partners, and an ability to tactically allocate capital as opportunities and risks shift across global equity and credit markets.

Analyzing markets today, the value of diversification is clearly on a cyclical upswing. Historically, these shifting asset class cycles often last for years. Investors are struggling with reduced return expectations from stocks, near-zero yields in bonds, and a far less robust portfolio from just a traditional asset allocation blend. The diversified multi-asset fund model, with a record of delivering consistent returns away from the directional or relational dependency on equities and fixed income, is having its day in the sun once again. Ensuring sufficient portfolio diversification has shifted from a nice-to-have to a need-to-have in the current, and likely future, market environment.

About the author

Joseph Burns is a managing director and head of Hedge Fund Solutions at iCapital Network, where he is responsible for leading the research team focusing on investment strategies across single and multi-manager product offerings.

IMPORTANT INFORMATION

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates . Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506 of Regulation D promulgated thereunder . An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments and, as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. . These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.